Who is continuing to buy BTC like crazy?

2025-05-26 13:47

2025-05-26 13:47On April 24th, Fidelity stated on X that "due to Listed Company's purchase, the supply of Bitcoin on exchanges is decreasing. This situation is expected to accelerate in the near future." Since the US election, Trump's loose expectations for the cryptocurrency field have undoubtedly boosted the market's potential expectations, and Listed Company has increased its purchase of nearly 350,000 Bitcoin.

The market game between exchanges, on-chain whales, and Listed Companies is also in full swing. Under the market turmoil, where will Bitcoin go in the future? This article will analyze the Bitcoin data indicators and overview the market dynamics.

The current stock of Bitcoin exchanges is 2.60 million, the lowest level since November 2018. Since November 2024, more than 425,000 bitcoins have been transferred from exchanges.

In this indicator, the important time point is in the second half of 2024, especially after Trump's election, there was a large outflow. At that time, Listed Companies in the US stock market were buying heavily, and this trend is still showing a downward trend today, reflected in various related entities (Listed Companies, etc.) increasing their Bitcoin reserves.

Since the US election, Listed Company has increased its holdings by nearly 350,000 bitcoins. Looking at the growth curve of its bitcoin holdings, Strategy, a major holder, has significantly increased its holdings by 107,000 bitcoins within two weeks since November 10, 2024, and has continued to increase its holdings to more than 531,000 bitcoins, with an average monthly increase of 42,000 bitcoins. Among Listed Company's holdings, there are 8 companies with more than 10,000 bitcoins, and each company's holdings have maintained a growth trend in the past six months.

Most of these Listed Companies' Bitcoin mNAV (stock market value to market value ratio) is between 1.4 and 2.25. If benchmarked at a ratio of 1:1, it is expected to release 50 billion USD liquidity to the Bitcoin market. Outside of the US, Asian Listed Companies such as Japan's Metaplanet and Hong Kong's HK Asia Holdings are increasing their allocation. Metaplanet CEO Simon Gerovich even stated that he plans to double his Bitcoin holdings from 5,000 this year.

Before January 2025, the data of spot Bitcoin ETF also coincided with the outflow of exchanges, with a maximum daily inflow of 18,000 Bitcoin, which to some extent promoted the surge of Bitcoin. Before the election, Strategy's average holding price was $42,000, and then it continued to increase its position to $67,000, proving that the long-term value of Bitcoin was recognized by the market.

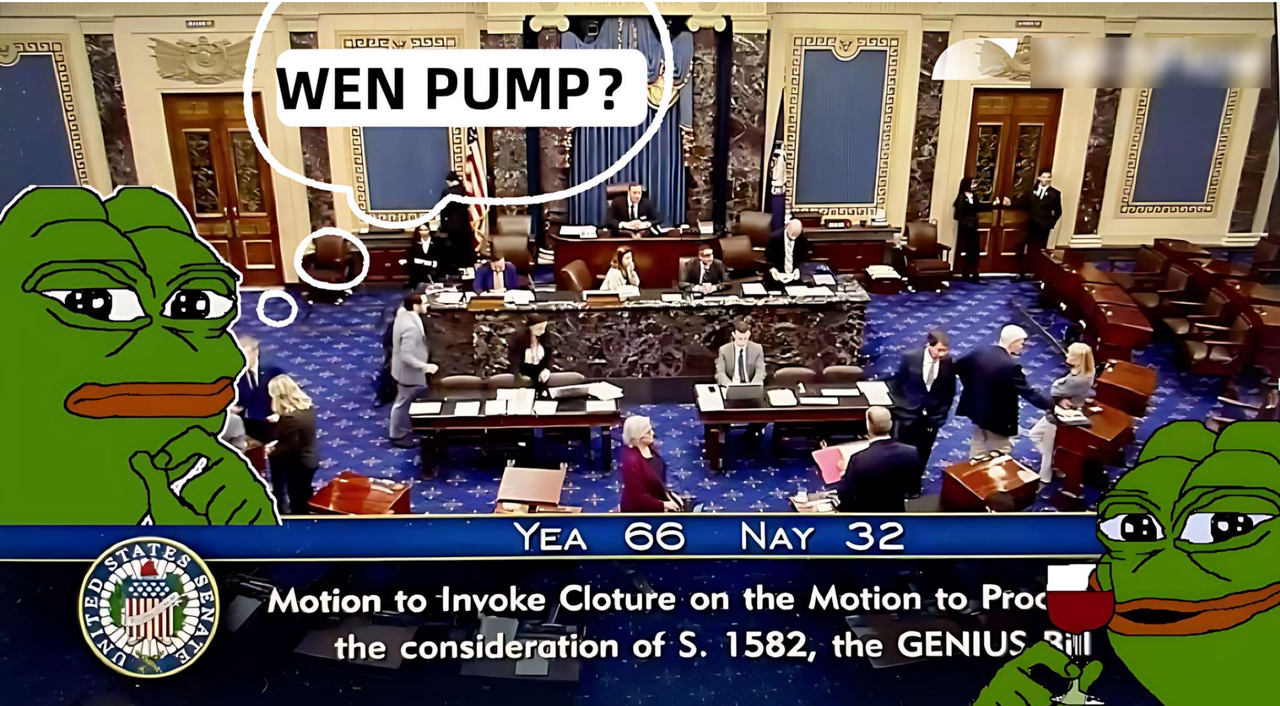

In addition, US policymakers are also accelerating the compliance reserve process. According to Bitcoin Laws data, three of the 27 states in the US that have submitted Bitcoin reserve bills have entered the second phase of submission (Arizona, New Hampshire, Texas), among which Arizona has entered the second phase of review. On March 7th, White House artificial intelligence and cryptocurrency advisor David Sacks stated that President Trump has signed an Executive Order on Bitcoin strategic reserves, but only reserves Bitcoin confiscated through criminal or civil processes.

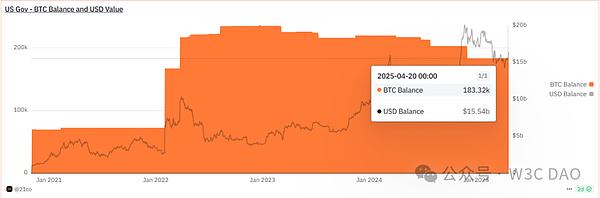

According to on-chain data statistics, the US government holds more than 183,000 bitcoins, accounting for 0.92% of the existing bitcoin circulation reserves, and the current market value exceeds $16.40 billion. With the gradual implementation of state laws, this number will further increase, which will also lower the threshold for US companies to hold bitcoin reserves.

For the industry, the entry of traditional funds into the market provides a reassuring pill, and due to the fact that most Listed Companies' Bitcoin investments are above the cost line (such as Strategy 1.4 times, Tesla 2.78 times), their expectations for Bitcoin investment are also optimistic. With the compliance direction in the cryptocurrency field and the "Trump Reserve" dust settled, ETF inflows have also increased again, which is expected to continue to strengthen the buying trend of Listed Companies.

Latest news

-

- See more

Bitcoin breaks through 110,000 dollars, regrets and misses of those years

On May 22, the 14th anniversary of Bitcoin Pizza Day, Bitcoin broke through the ...

2025-05-26

2025-05-26

-

- See more

Rethinking Bitcoin's Lightning Network Design from a Thunderbolt Perspective

Why can't I buy coffee with bitcoin?When most people think of Bitcoin, the first...

2025-05-26

2025-05-26